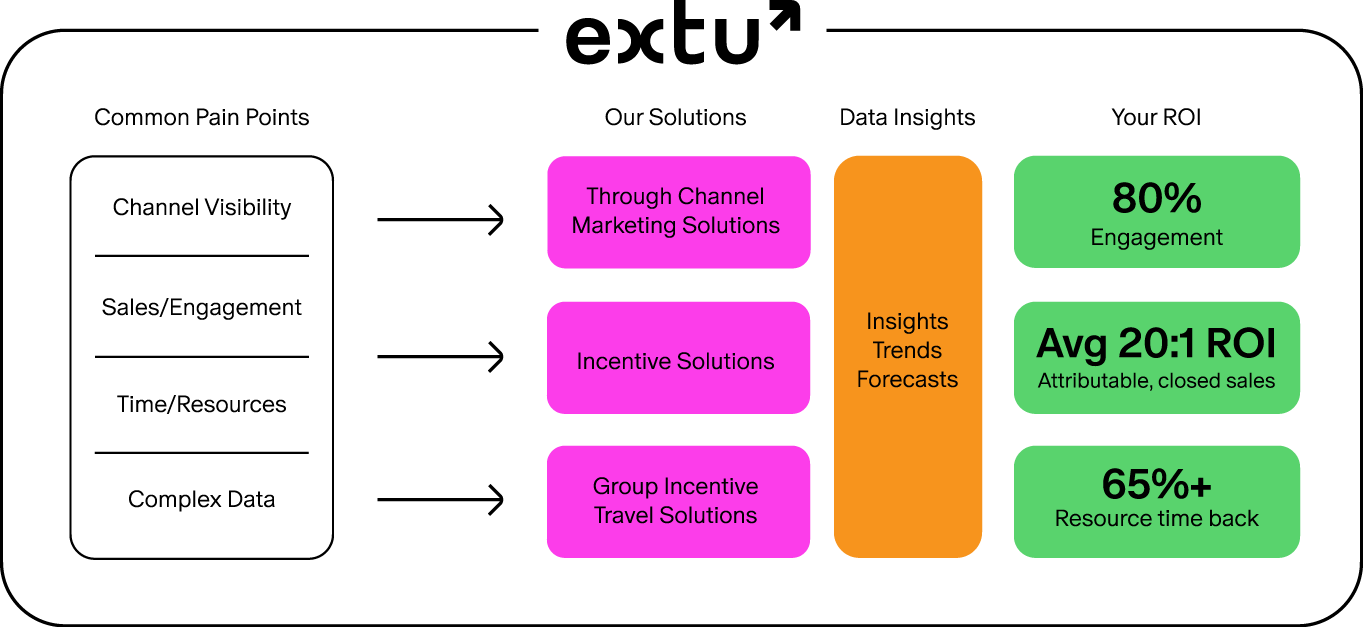

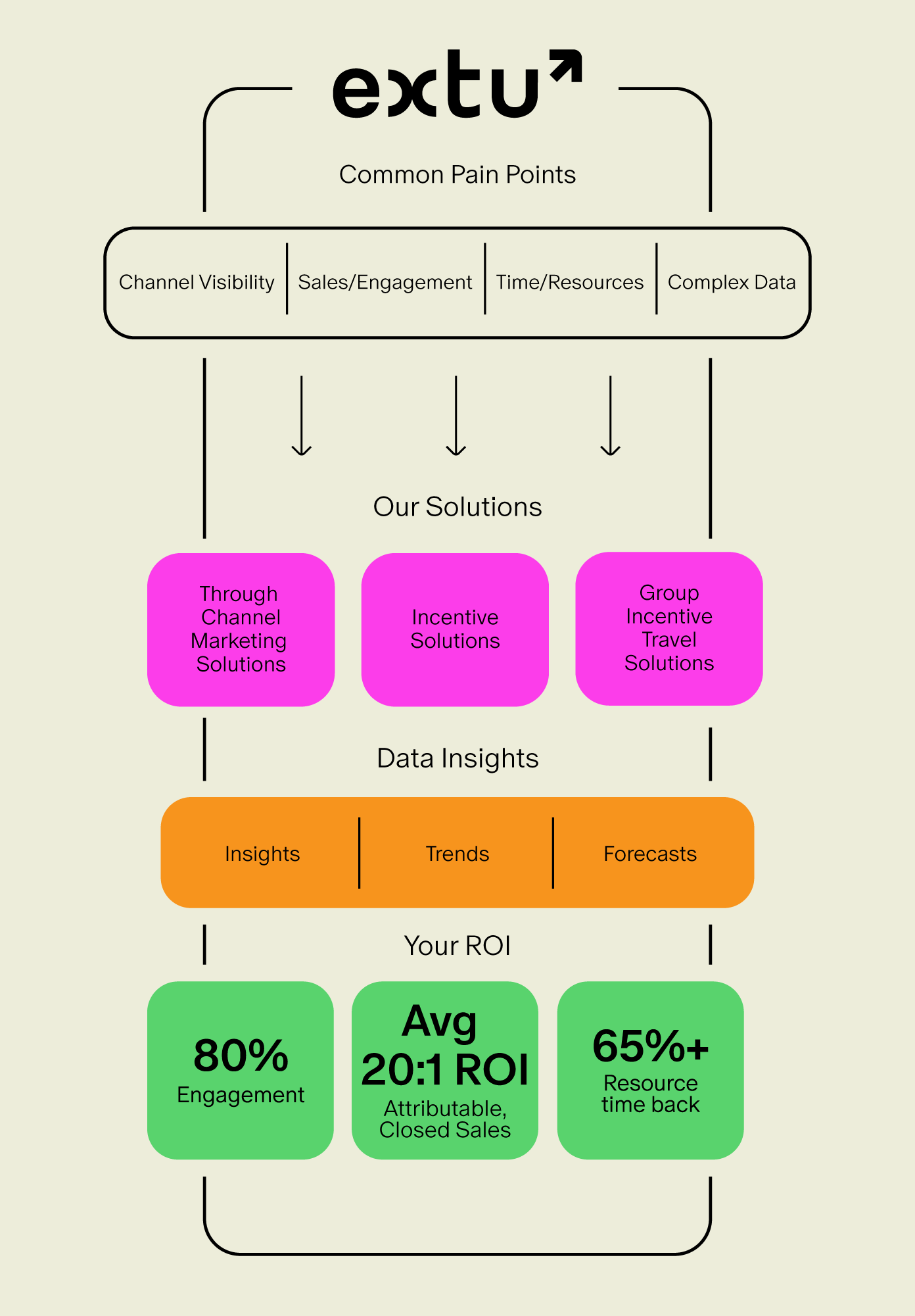

Grow revenue with Extu’s partner experience platform.

Automated ai-generated marketing campaigns and incentive rewards for mid-market companies. We deliver 80% engagement rates and 20:1 ROI on attributable sales.

Power Your Channel Marketing

Simply put, we’re a channel marketing company that helps you better engage with your partners, understand your customers and drive sales.

Power Your Channel Marketing

Simply put, we’re a channel marketing company that helps you better engage with your partners, understand your customers and drive sales.

Sign me up!Own the Channel With Savvy B2B Marketing

You won’t find a B2B marketing company that’s more dedicated to your channel success.

Extu is trusted by companies like:

ROI-Driven Channel Marketing Solutions:

Through Channel Marketing

Create a channel marketing strategy that not only empowers channel partners but also increases marketing ROI.

Tell me more.

Channel Incentives Marketing

Motivate channel partners with loyalty programs and rewards that get them to move inventory, drive sales and stay engaged.

Tell me more.

Incentive Travel

Build loyalty and win mindshare with a custom travel program that celebrates high performers and tracks your ROI.

Tell me more.See the Big Picture of your Channel Partner Program:

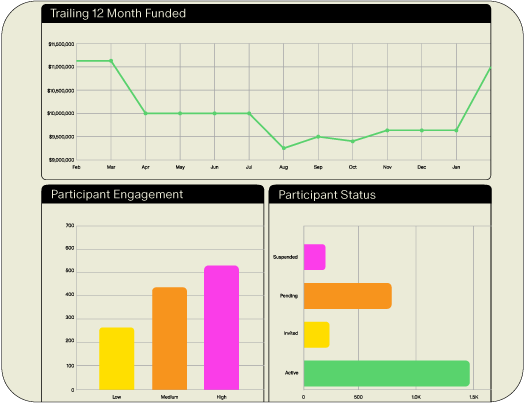

Gain Customer Data

Your channel has a lot of complexities, with many data points and participants. Extu’s technology gathers this data—in real-time— into one central place so you can see the full picture.

Seamlessly Connect and Integrate B2B Channel Programs

Extu makes sure all your channel marketing programs are speaking the same language by integrating with outside technology and pulling data from every source.

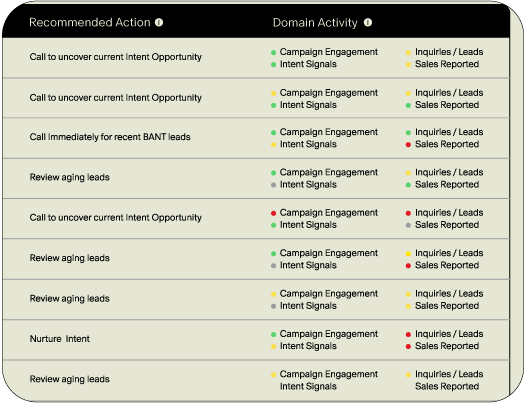

Understand & Reward Behaviors

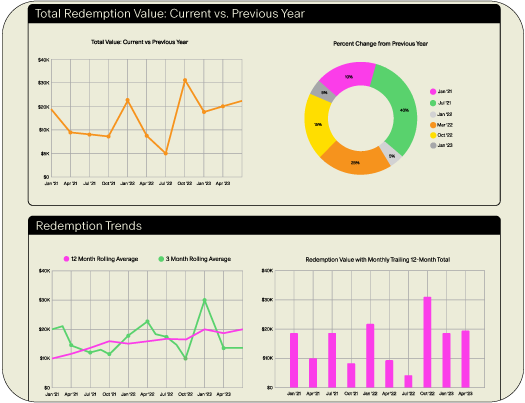

We look at partner marketing performance and sales receipts to quickly see trends from a wide lens down to the individual level. You can also reward your highest performers and track redemption.

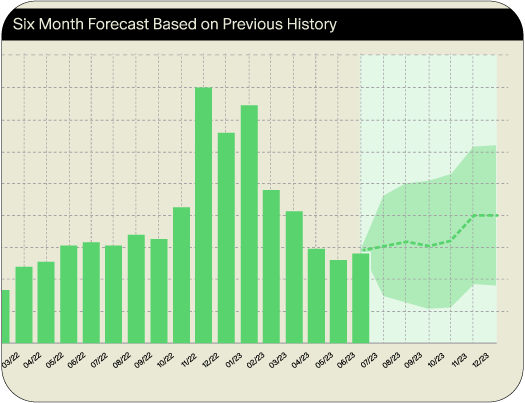

Forecast with Confidence

At Extu, we look at the full picture with you and provide actionable insights that allow you to make informed marketing decisions and drive proactive campaigns.

See the Big Picture of your Channel Partner Program:

See the Big Picture of your Channel Partner Program:

- 01 / 04

Gain Customer Data

Your channel has a lot of complexities, with many data points and participants. Our technology gathers this data—in real-time— into one central place so you can see the full picture.

This will be a product illustration of the Insights Hub

See the Big Picture of your Channel Partner Program:

- 02 / 04

Seamlessly Connect and Integrate B2B Channel Programs

We make sure all your channel marketing programs are speaking the same language by integrating with outside technology and pulling data from every source.

This will be a product illustration of the Insights Hub

See the Big Picture of your Channel Partner Program:

- 03 / 04

Understand & Reward Behaviors

We look at partner marketing performance and sales receipts to quickly see trends from a wide lens down to the individual level. You can also reward your highest performers and track redemption.

This will be a product illustration of the Insights Hub

See the Big Picture of your Channel Partner Program:

- 04 / 04

Forecast with Confidence

We look at the full picture with you and provide actionable insights that allow you to make informed marketing decisions and drive proactive campaigns.

This will be a product illustration of the Insights Hub

Services that Relieve your Resources:

Our team of channel experts are here to do the heavy lifting so you can focus on what you do best.

Incentive Management Services

Give participants a delightful reward experience from beginning to end—without lifting a finger.

Channel Marketing Services

Get fully-packaged, high quality multimedia content—including thought leadership and industry news.

Travel Services

Achieve the perfect balance of memory-making fun and goal-achieving business success.